In the past, the surest way to be ‘liquid’ i.e. to have money to spend at a moment’s notice, anywhere, anytime, was to have physical cash in your wallet. Cash was king, but not so much anymore. First, credit cards were introduced, then debit cards and now there is a global trend towards mobile cashless and cardless payments powered by smartphone apps, some of which are simple payments platforms and others that are fully fledged digital banks. Check out this link on China going cashless- https://youtu.be/gysKE3POUv0.

If you’ve heard of Apple Pay, Samsung Pay or Android Pay, then you’ve heard of some of the biggest players in the world in this field. These products let you combine all of your bank accounts, cards and other instruments into a single access point, your phone, which you can then use to pay with NFC, QR Codes or using a unique identifier such as your mobile phone number.

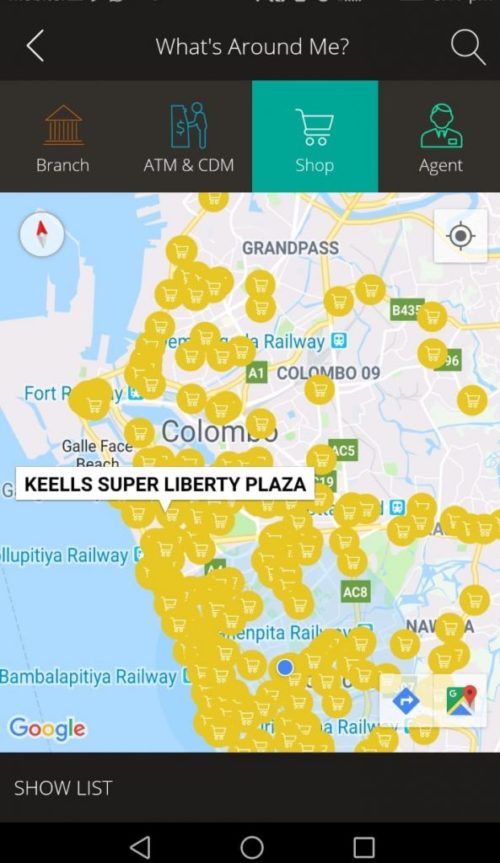

The move to mobile payments has been spurred on globally by the FinTech revolution. What is FinTech? It’s the combination of modern technology and financial services to make banking and payments seamless and more accessible than ever. This trend is picking up strongly in Sri Lanka and was, arguably, led by FriMi – Sri Lanka’s first fully fledged digital bank and mobile payments platform. The growth in demand for such solutions in Sri Lanka has been phenomenal, as witnessed by the high rates of adoption of such platforms in terms of both users and merchants. For example, with FriMi being accepted at all Keells supermarkets, you can pay for your weekly groceries without your wallet, using just your phone. In fact, since its inception in 2017, FriMi’s merchant network has grown to include over 2,000 locations.

FriMi’s success in Sri Lanka has given rise to a host of competitors hungry for a share of the growing and lucrative market for mobile payments in Sri Lanka. Pay by Genie, UPay, iPay and PayApp are some examples of the players in this new and burgeoning industry. With online registration, no elaborate forms and superb user-friendliness, this is the convenience Sri Lankans have always dreamed of and all you need is a smartphone!

Digital banks and financial services providers make it possible to instantaneously make payments and transfer funds between users with no delays; FriMi provides all of this free to its users, unlike some other platforms. Users are also able to request for funds from people within their circles if and when required. Other features of such platforms include instant funding through cash deposits where available and digital funds transfers from anywhere in the world. As technology has done throughout history, digital banks and mobile payments platforms are bringing financial ease and accessibility to the masses, particularly the younger generation who tend to be weary of traditional banking. With the advent of FinTech, your bank is now essentially in your pocket and you can transact as, when, where and how you like. From a marketing standpoint too, FriMi has been quite a revolution and has set a benchmark for others to follow. It dedicates hardly any resources to traditional marketing and has instead devoted its resources to guerilla marketing tactics (about which you can learn more here) and concentrated its efforts on social media and other digital channels. With a platform as efficient and useful as this, they’ve also relied heavily on word of mouth to gain traction.

One of the most important guerilla marketing tactics used by the brand has been its unbelievable, limited offers. When they launched they gave users 99% off at Odel and then they invited users to spend LKR 5,000/- at G Flock but pay only LKR 50/- during a two hour window. Subsequently they have and still are conducting similar promotions. This kind of guerilla marketing has created massive hype for them and seen their user base strengthen dramatically. Their informal, friendly style and innovative social media campaigns have helped them gain a large following. Through the use of innovative marketing tactics, and an almost entirely social media based marketing strategy, the platform has gone from strength to strength without expending vast amounts of resources.

Speaking about their journey, the team at FriMi said, ‘FriMi is different things to different people. The platform is so capable and feature rich that not everyone is going to use all of it. However, different people will find it useful for different situations based on their circumstances. When we launched, people were in the process of moving from cash to cards, but we jumped ahead and moved straight to a true digital transaction model. Currently, we are introducing bill presentation, which means you can see your utility bills for the last 3 months right on the app itself. Other useful and powerful features are also in development.’

FinTech hasn’t just revolutionized things for consumers; it’s changed the way merchants do business too. With an extremely low bar to entry, especially when compared with credit/debit cards digital payments are now accessible by even the smallest of businesses. Transaction fees on FinTech platforms are also significantly lower than other channels like cards and require less infrastructure and investment. Merchants can also use these platforms to easily tap into a wide and varied clientele.

We hope that the FinTech industry will continue to challenge established practices to make life easier for all of us. What do you think of FriMi and the FinTech revolution? Are you a user? If not, would you like to try it? Let us know in the comments below.